|

Amortization

|

The process of repaying a loan or depreciating an asset over time. Term

|

Financing and accounting

|

|

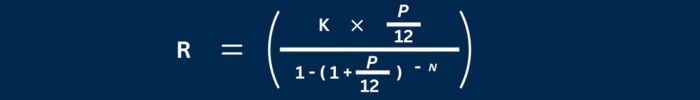

Annuity

|

A constant periodic payment that includes both interest and amortization of a loan.

|

Loan repayment

|

|

Repayment

|

The part of a regular payment that is used to repay the original loan amount.

|

Loan repayment

|

|

Interest

|

The cost of borrowed money, calculated as a percentage of the outstanding loan amount.

|

Loan repayment and financing

|

|

Repayment schedule

|

A schedule that shows the regular payments for repaying a loan over time.

|

Loan repayment

|

|

Residual debt

|

The remaining loan amount to be paid after a certain number of payments.

|

Loan repayment

|

|

Term

|

The period over which a loan must be repaid.

|

Loan repayment and financing

|

|

Nominal interest rate

|

The contractually agreed interest rate of a loan, excluding fees or inflation.

|

Loan repayment and financing

|

|

Effective interest rate

|

The actual interest rate of a loan, taking into account all fees and costs.

|

Loan repayment and financing

|

|

Loan amount

|

The original amount borrowed on a loan.

|

Loan repayment and financing

|

|

Initial investment

|

The amount spent at the beginning of an investment project.

|

Investment planning

|

|

Cash flow

|

The net amount of cash flowing into and out of a company.

|

Financial Planning and Investment Valuation

|

|

Discount rate

|

The interest rate used to discount future cash flows to their present value.

|

Financial Planning and Investment Valuation

|

|

Net present value

|

The present value of all future cash flows of an investment, less the initial investment.

|

Investment valuation

|

|

Discounting

|

The process of calculating the present value of future cash flows using a discount rate.

|

Financial Planning and Investment Valuation

|

|

Useful life

|

The period over which an asset can be used economically.

|

Accounting and depreciation

|

|

Residual value

|

The estimated value of an asset at the end of its useful life.

|

Accounting and depreciation

|

|

Book value

|

The value of an asset as shown in a company's financial accounts.

|

Depreciation and amortization

|

|

Declining balance depreciation

|

A depreciation method in which the value of an asset is initially depreciated at a faster rate.

|

Accounting and tax planning

|

|

Straight-line depreciation

|

A depreciation method in which the value of an asset is depreciated evenly over its useful life.

|

Accounting and tax planning

|

|

Performance-based depreciation

|

A depreciation method based on the actual use or performance of an asset.

|

Accounting and tax planning

|