|

Defining goals and framework conditions

|

Short-term goals

|

Ensuring liquidity

|

|

|

|

Covering monthly operating costs

|

|

|

Medium-term goals

|

Investment in new machines

|

|

|

|

Increase marketing expenditure to increase sales

|

|

|

Long-term goals

|

Opening a second business location

|

|

|

|

Build up a reserve for unforeseen expenses

|

|

Analysis of the current financial situation

|

Income

|

Monthly turnover: € 50,000

|

|

|

|

Additional income (e.g. interest): € 500

|

|

|

Expenses

|

Rent: € 3,000

|

|

|

|

Salaries: € 20,000

|

|

|

|

Material costs: € 15,000

|

|

|

|

Other operating costs: € 5,000

|

|

|

|

Marketing: € 2,000

|

|

|

|

Insurance and taxes: € 2,500

|

|

|

Liquidity

|

Bank balances: € 20,000

|

|

|

|

Outstanding receivables: € 10,000

|

|

|

|

Liabilities: € 5,000

|

|

Budgeting and Financial Planning

|

Short-term budget

|

Total income: € 50,500

|

|

|

|

Total expenditure: € 47,500

|

|

|

|

Monthly surplus: € 3,000

|

|

|

Long-term budget (next 3 years)

|

Expected annual increase in income: 10%

|

|

|

|

Planned investments: € 50,000 (new machines), € 100,000 (second location)

|

|

Liquidity planning

|

Cash flow forecast for the next quarter

|

January: € +3,000

|

|

|

|

February: € +3,000

|

|

|

|

March: € +3,000

|

|

|

|

Total: +€ 9,000

|

|

|

|

Liquidity reserve: target of € 30,000 within one year

|

|

Debt management

|

Current debt

|

€ 5,000

|

|

|

Repayment plan

|

Repayment of € 1,000 per month, debt-free in 5 months

|

|

Investment planning

|

New machines

|

€ 50,000 investment in 6 months

|

|

|

Opening of second location

|

€ 100,000 in 18 months

|

|

|

Profitability analysis

|

Expected increase in turnover through investment: 20% in the first year

|

|

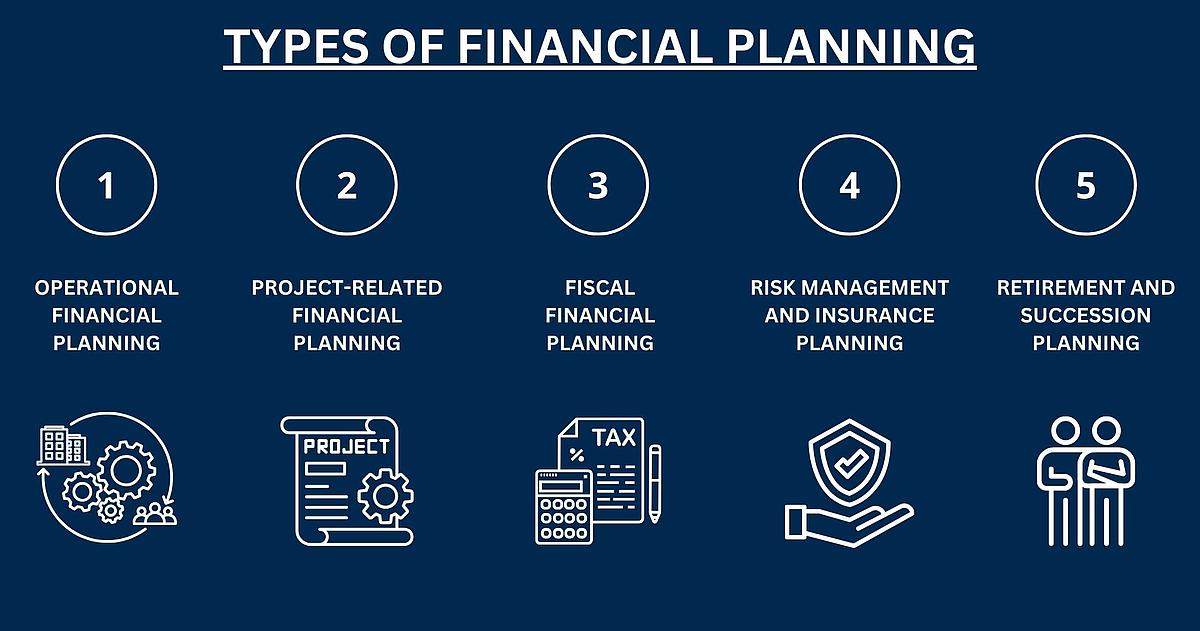

Risk management

|

Risk assessment

|

Material price increases, slump in demand

|

|

|

Hedging strategies

|

Long-term supply contracts, building up a liquidity reserve

|

|

Tax planning

|

Utilizing tax advantages

|

Depreciation of new machines, tax deductibility of operating costs

|

|

|

Tax forecast

|

Annual tax burden based on current profit: € 10,000

|

|

Asset planning

|

Asset accumulation

|

Reinvestment of surpluses in the company

|

|

|

Asset management

|

Regular review of investment decisions

|

|

Retirement planning

|

Owners

|

Private retirement provision through pension insurance

|

|

|

Employees

|

Offering a company pension plan

|

|

Succession and inheritance planning

|

Succession planning

|

Preparation of a succession plan for the company director

|

|

|

Inheritance planning

|

Advice from a tax advisor to minimize inheritance taxes

|

|

Monitoring and adjustment

|

Financial controlling

|

Monthly review of financial results

|

|

|

Adjustments

|

Adjustment of the budget if necessary, e.g. in the event of deviations in turnover

|

|

Documentation and communication

|

Documentation

|

Thorough recording of all financial plans and decisions

|

|

|

Communication

|

Regular reports to investors and employees on the financial situation and planned measures

|

|

Goal setting and strategy development

|

Short-term goals

|

Increasing the monthly surplus to € 5,000

|

|

|

Medium-term goals

|

Increase sales by 30% in the next 3 years

|

|

|

Long-term goals

|

Establishment as a leading provider of handmade furniture in the region

|