Recession Meaning: What is a recession?

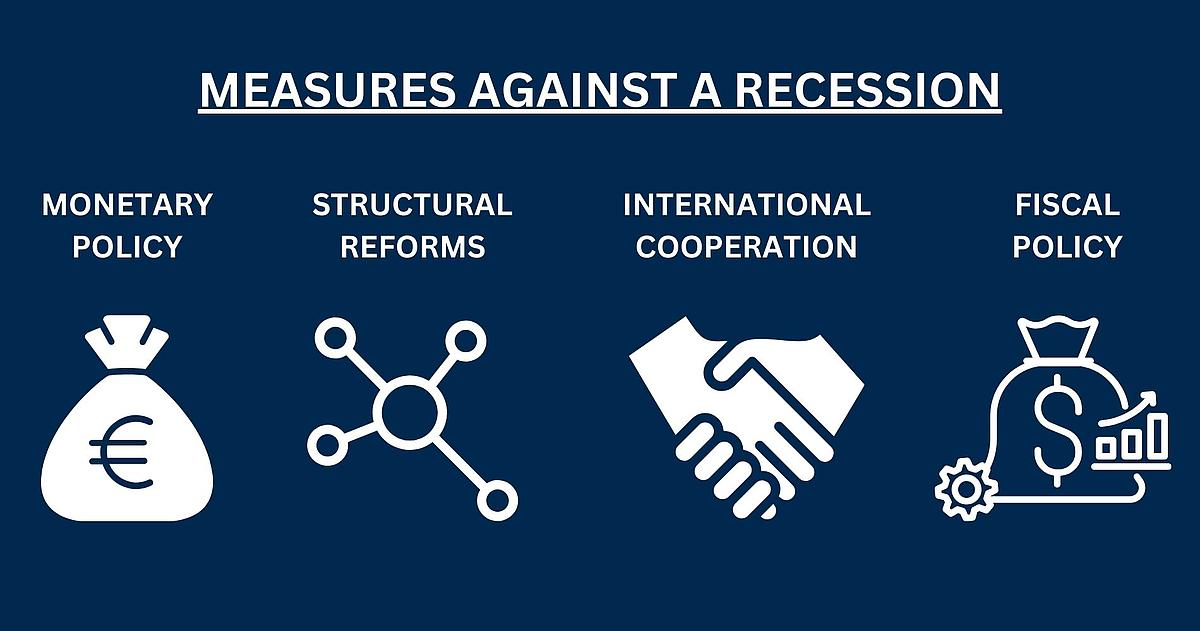

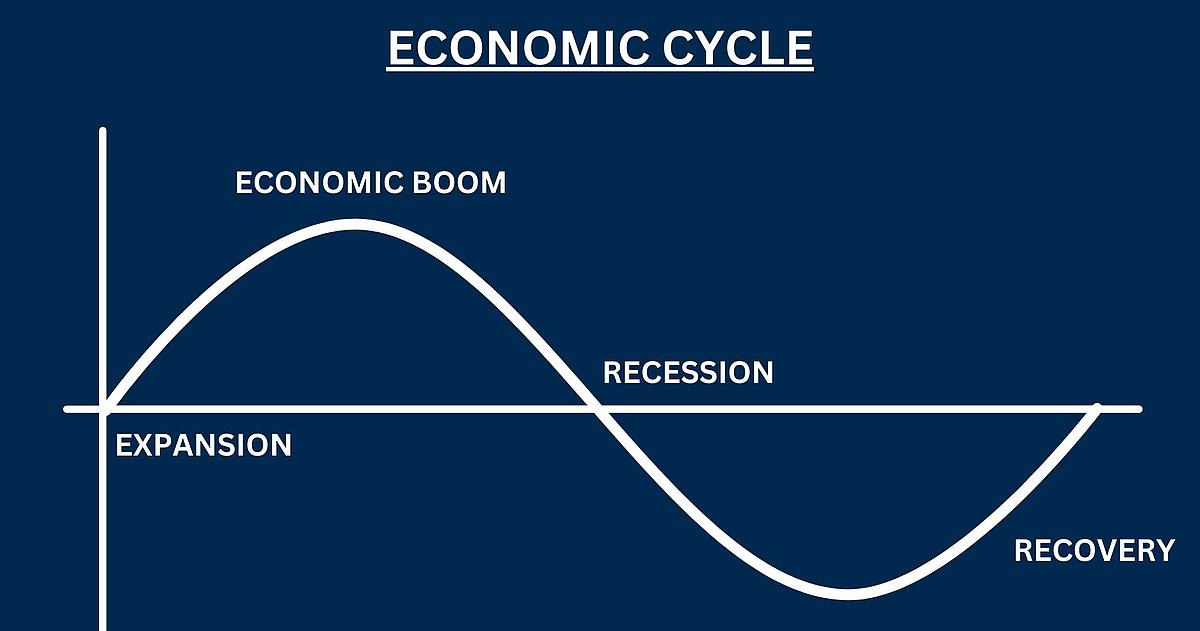

A recession is a phase of economic downturn characterized by a significant decline in economic activity over a prolonged period of time, typically indicated by a decline in gross domestic product (GDP) for two consecutive quarters. This condition manifests itself in a variety of negative developments, such as an increase in unemployment, a decline in consumer spending, a reduction in industrial production and investment, and a general decline in confidence in the economy. Recessions are part of the natural economic cycle and can be triggered by various factors, including financial crises, external shocks, high inflation rates or political uncertainty. Overcoming a recession often requires coordinated economic policy measures to stabilize the economy and lay the foundations for recovery.

Definition of the term: What does the word recession mean?

The word "recession" comes from the Latin "recessio", which means decline or retreat. The term was originally used to describe a general slowdown in the economy and has evolved over time into a technical term in economics that specifically denotes two or more consecutive quarters of negative growth in gross domestic product (GDP). The term thus reflects a period in which the economy "declines" or is in a state of contraction, as opposed to expansion or growth.

Recession Significance for the economy

A recession has far-reaching effects on the economy and the monetary system, which can change the foundations and functioning of the economic ecosystem:

- Economic growth: The most obvious characteristic of a recession is the decline in economic growth, measured in terms of gross domestic product (GDP). This decline signals a reduction in goods and services produced.

- Investment: Companies and individuals are often reluctant to invest capital in times of uncertainty. This leads to a decline in investment, which in turn can inhibit the economy's future growth potential.

- Interest rates: Central banks may lower interest rates in response to a recession in order to stimulate the economy. Lower interest rates are designed to encourage investment and spending, but can also reduce incentives to save.

- Inflation: The impact of a recession on inflation can be mixed. While a slowdown in demand can lead to lower prices (deflation), monetary policy measures to combat the recession can encourage inflationary tendencies in the long term.

- Corporate profits and insolvencies: Profits decline as demand falls, which can lead to a higher rate of insolvencies, especially among financially weaker companies.

- Labor market: Unemployment rises as companies reduce their workforce due to lower demand and profits.

- State finances: On the one hand, government revenues fall due to lower tax receipts. On the other hand, spending on social safety nets often increases, which can increase budget deficits.

- Exchange rates: The currency of a country going through a recession can lose value against other currencies, which increases import costs and reduces purchasing power abroad.

A recession therefore affects both the micro and macro levels of the economy, affecting financial conditions, investment activity, government budgetary policy and general living standards. Coping with its effects requires coordinated policy measures to mitigate the negative effects and lay the foundations for recovery.