This Website uses cookies to improve your visit on our website. More Info

Content and Prospects

- MBS QUICK FACTS:

- State recognized since 1999

- September

- 18 or 24 Months

- English

- Book a consultation appointment

DID YOU KNOW?

In 2024, Munich Business School secured the top spot among private universities of applied sciences in the field of business administration from a recruitment perspective for the fifth time in a row.

A degree in mergers and acquisitions (M&A) is a specialized academic program that focuses on the theory and practice of corporate mergers and acquisitions. It provides students with the skills and knowledge to plan, analyze, and execute complex transactions in the corporate world. The program combines content from various disciplines, such as economics, law, finance, strategic management, and negotiation. Typical topics include company valuation, due diligence, contract design, financing transactions, and integrating companies after a merger. The aim of M&A studies is to prepare alumni for a career in areas such as investment banking, management consulting, auditing or strategic corporate management. The course of study is often offered as a master's program because it requires in-depth knowledge and often professional experience. Some universities also offer specialized courses or further education in the field of M&A.

Download Information Material

In our exclusive and non-binding information material, you can find out everything you need to know about:

To successfully complete a course of study in the field of mergers and acquisitions (M&A) and later work in this demanding field, both formal requirements and personal qualities are crucial. Here is an overview:

With a combination of prior knowledge, analytical skills and the right personal qualities, the requirements for successful studies and a career in M&A are optimally met.

In Germany, there are various opportunities for further education in the field of mergers and acquisitions (M&A). The courses are designed to provide both theoretical knowledge and practical skills in areas such as company valuation, contract design and strategic integration. Here are some of the typical programs of study:

These study options offer a sound education for anyone who wants to specialize in the complex challenges and opportunities in the field of mergers and acquisitions.

At Munich Business School, you can study Finance in the Master program with a focus on mergers and acquisitions. This gives you the perfect mix of business knowledge and practical experience and project management skills, for example through a business project, to help you shape your future according to your ideas. These are the most important facts about studying at MBS:

18 or 24 Months

Master of Arts

Every September

Master in Finance

English

EUR 8.580 per Semester

In person at the campus in Munich

Electives, Mentoring Program & Business Project

Areas of focus such as Mergers and Acquisitions, etc.

That's what you'll learn in the

Mergers & Acquisitions program

| Category | Course content |

|---|---|

| Business valuation and financial analysis | Methods of business valuation (e.g. discounted cash flow, multiplier method), analysis of financial ratios and annual financial statements, risk management in M&A processes |

| Legal aspects of M&A | Contract design for mergers and acquisitions, corporate law, tax law and competition law, due diligence from a legal perspective, regulations for international transactions |

| Strategic and operational planning | Development of M&A strategies, synergy effects and their quantification, integration of companies after an acquisition (post-merger integration), restructuring measures |

| Financing transactions | Financing options for acquisitions (e.g. equity, debt, leveraged buyouts), capital structure and its impact on transactions, private equity and venture capital |

| Negotiation and communication strategies | Negotiations in M&A processes, communication with stakeholders, conflict management in mergers and acquisitions |

| International Aspects | Cross-border transactions and cultural challenges, international M&A markets and trends, global regulation and its impact on M&A |

| Case Studies and Practical Exercises | Analysis of real M&A deals, simulation of negotiation and decision-making processes, creation of business plans for M&A projects |

| Technological innovations and M&A | Use of modern technologies such as big data and artificial intelligence in transaction analysis, digitalization and its impact on M&A, |

| Soft skills (optional) | Leadership skills and teamwork, time management and stress management, ethics and corporate social responsibility (CSR) in M&A processes |

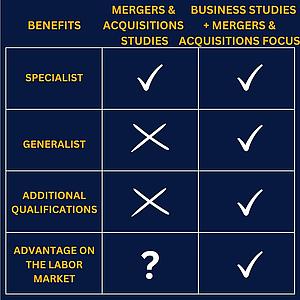

Studying business administration with a focus on mergers and acquisitions (M&A) offers you a broader and more versatile foundation than a degree program that specializes purely in M&A. While an M&A degree program is highly focused on the specific aspects of corporate mergers and acquisitions, a business degree program gives you access to a broader spectrum of business knowledge, such as marketing, controlling, human resource management or finance. This holistic perspective is particularly valuable because M&A transactions are heavily influenced by other areas such as corporate strategy and operational efficiency.

Furthermore, a business degree offers you more flexibility in the job market. If your professional interest changes or you want to reorient yourself, a sound business education is more versatile, while a purely M&A-focused education limits you to that specific field. With a business degree and a specialization in M&A, you can cover both breadth and depth and are optimally prepared for a career that includes not only M&A but also other business challenges.

Munich Business School not only offers you an excellent business degree program, but also focuses on international business so that you can pursue your chosen career anywhere in the world after graduation. The MBS Master in Finance offers many highlights such as a semester abroad, several internships, business projects, plenty of networking opportunities and much more. At Munich Business School, you can expect small study groups, dedicated teachers and award-winning programs. But more importantly, your name matters to us. Here, you are not an anonymous member, but the driving force that motivates us every morning. As a small, private university, we take time for your concerns and offer you a customized study experience. Our lecturers have extensive practical experience and teach you skills that really count. In addition to sound business knowledge, we also promote values and abilities that, as a future mergers & acquisitions expert, will bring you closer to sustainability and social responsibility and optimally prepare you for a wide range of professions.

Munich Business School offers students a number of advantages that are only possible thanks to the structure of a private university of applied sciences. You will benefit from the following advantages during your studies at MBS:

Professors with business experience and guest lectures by specialists

Support through, for example, networking events and small class sizes

in Finance and Management

Broad knowledge through business studies and specialized knowledge through interesting areas of focus

A business project & students from around the world

Ein Studium im Bereich Mergers & Acquisitions ist oft als spezialisierter Master- oder Weiterbildungsstudiengang konzipiert. Hier ist eine typische Struktur:

Introductory phase: Fundamentals and overview

Advanced phase: Specialization and practice

Final phase: practice-oriented projects and final thesis

The program often concludes with a graduation ceremony at which the graduates receive their certificates and, depending on the institution, certificates for special qualifications.

APPLICATION

You must meet certain academic, linguistic and, in some cases, professional requirements to be eligible for our Master’s in Finance. You can submit your application documents at any time. However, given the limited number of spaces on our programs, we recommend applying well before your preferred start date.

The main requirement for admission to the Master in Finance study program is a successful Bachelor's degree (180 ECTS or more). Applicants with a degree in Business Studies/Management/Economics are entitled to apply for the program directly, applicants without a degree in economics can qualify for the program by completing the Pre Master Program. Upon request, we will gladly verify your documents in advance. Please contact your Program Advisor.

English Proficiency

Applicants must proof their English language skills by passing one of the following language tests:

Note: If the test is also used to apply for a visa, please check the requirements of the respective embassy in advance.

Test results can only be accepted if achieved within the last two years. If you are unable to obtain your test results before handing in your MBS application, please inform us about your planned test date.

The English proficiency test can be waived by the following candidates:

We accept applications all year round. However, we recommend that you apply as early as possible, as the number of places is limited.

Spring semester (Master International Business only)

Applicants from Vietnam, China and India should allow an extra month to apply for the relevant visas.

Winter semester

Applicants from Vietnam, China and India should allow an extra month to apply for the relevant visas.

You must submit the following mandatory documents for us to consider your written application:

*Please submit the relevant original document, or a certified copy, as soon as you are accepted onto the program.

Online application:

Apply online for the Master’s program in International Business

Eligible applicants will be invited to a personal interview, either in person in Munich or online via Microsoft Teams (approx. 30–45 minutes). The interview may include examining a case study.

As soon as you are accepted onto the program, you will have the opportunity to get to know Munich Business School a little better – before you make the final decision about your studies. And, of course, our student advisors will be available to answer any questions you have.

When we confirm your place, we will send you confirmation of your acceptance along with two copies of your study contact. To secure your place, please sign and return one copy of the contract to us within two weeks. You can keep the other copy for your files.

Additionally, in order to be formally accepted onto the program, you must pay a one-off matriculation fee of €690 (EU/EFTA) or €1,490 (non-EU) and make an advance payment of €1.990. This advance payment will be deducted from your first tuition fee payment.

If you are a non-EU citizen, you must apply for a student visa in order to start your studies in Germany. You will require a letter of invitation from Munich Business School to secure your visa – which we will be happy to provide once we receive your signed student contract and a copy of your passport.

Munich Business School offers attractive scholarship programs amount up to EUR 4,000 of the overall tuition fee. (Up to EUR 2,000 on the 1st and 2nd master's semester).

If you wish to apply for a scholarship, you should include an application when you submit your overall application. You can find further information on our scholarships and financing page.

“I approached the program with the expectation that after graduation I would have the necessary skills to implement my own ideas. I can clearly confirm this. After a three-month practical project in which I was able to implement my own idea, my learning curve went steeply upwards.

I felt very comfortable from the very beginning thanks to great support throughout the entire time. Likewise, the many practical projects with companies such as Flixbus have helped me to enter the working world well prepared. For anyone looking for an international and future-oriented course of study, Munich Business School is the right university.

I can also confirm that the university's international orientation is unique. Through my time at the university, I have been able to build up a global network that has become extremely valuable to me, not only professionally but also personally.”

Philipp on StudyCHECK

Salaries in the field of mergers and acquisitions (M&A) vary greatly and depend on factors such as position, professional experience, company size and location. Here are typical salary ranges:

The M&A sector is characterized by above-average salaries and performance-related compensation systems, particularly in specialized and internationally operating companies.

The Munich Business School in Numbers

The following professions offer a wide range of opportunities to specialize and work in different industries after completing an M&A degree.

| Job title | Description of tasks | Employer |

|---|---|---|

| M&A Analyst | Conducting market and company analyses, providing support for due diligence, creating financial models. | Investment banks, consulting firms, large companies. |

| M&A Consultant | Advising companies on mergers and acquisitions, strategy development, conducting negotiations. | Management consultancies, specialized M&A consultancies. |

| Corporate finance analyst | Analysis of corporate finances, evaluation of investment opportunities, support with financing issues. | Companies, banks, private equity firms. |

| Investment banking associate | Development of financing concepts, support with M&A transactions, negotiation support. | Investment banks, venture capital firms. |

| Private equity manager | Managing funds, analyzing investment opportunities, managing portfolio companies. | Private equity and venture capital firms. |

| In-house M&A manager | Responsibility for the M&A strategy of your own company, identifying acquisition targets, integration. | Large companies with their own M&A departments (e.g. automotive or pharmaceutical companies). |

| Strategy consultant | Support with strategic corporate decisions, market analyses, development of growth strategies. | Strategy consultancies, consulting firms. |

| Post-merger integration manager | Planning and implementing the integration of companies after a merger, ensuring synergies. | Management consultancies, large corporations with an M&A focus. |

| Legal counsel in M&A | Advising on legal issues, contract drafting, ensuring compliance. | Law firms, specialized legal departments of large companies. |

| Risk manager in M&A | Analysis of risks in mergers and acquisitions, development of hedging strategies. | Insurance companies, banks, large corporations. |

Have you ever wondered which professions would be suitable for you with a business degree from MBS?

Then take a look at our page on business administration careers. There, we explain many of the professions that you can pursue with a business degree.

Business Administration JobsThe diversity of the mergers and acquisitions sector is reflected in a number of exciting professional fields. Here is a closer look at three examples of professions:

Responsibilities: M&A analysts conduct market and company research, create financial models, and assist in company valuations. They work closely with teams preparing mergers or acquisitions and prepare reports and presentations for investors and decision-makers.

Special feature: This position offers the opportunity to work in a dynamic, analytical environment and to gain deep insights into strategic decisions at an early stage. The job is often the entry point into a career in investment banking or management consulting.

Responsibilities: Private equity managers analyze investment opportunities in companies, manage funds and work with portfolio companies to increase their value. They develop growth strategies, oversee acquisitions and play a key role in preparing exits, such as sales or IPOs.

Special feature: The work combines strategic analysis with practical implementation. It is a highly profitable area with intense challenges and international career opportunities.

Responsibilities: These managers are responsible for planning and implementing the integration of two companies following a merger or acquisition. They coordinate teams, optimize processes and ensure that synergies are realized without disrupting ongoing operations.

Special feature: The focus on organizational change makes this position particularly exciting. It requires interdisciplinary knowledge in finance, strategy and corporate culture. Successful integration can ensure long-term success for companies, which makes this role crucial.

DID YOU KNOW?

After an MBS Bachelor's or Master's degree, you can also take up all these professions abroad without any problems.

No, business law is not a purely economic course of study, but an interdisciplinary mixture of law and economics. The focus is on legal topics with an economic reference, whereby business and economic fundamentals are also taught. It is more legally oriented, but you also learn about economic interrelationships.

Whether or not studying business law is difficult depends mainly on your interests and abilities. It requires a good understanding of legal and economic interrelationships, as well as the ability to analyze complex issues. If you can work in a structured way and are enthusiastic about legal and economic topics, it is quite manageable.

Most people who start a business law degree manage to complete it, as it often offers a good mix of theory and practice. However, the exact proportion depends on the university and the individual motivation. With commitment and stamina, the chances are good.

During your business law studies, you will learn the basics of law, such as civil law, commercial and corporate law, as well as economics topics such as business administration and economics. The program is usually divided into modules that include lectures, seminars and practical exercises. At the end, there are often exams, term papers and a bachelor's thesis. Internships or practical projects are often part of the program to apply the content.

After studying business law, you will be a business lawyer. You are not a fully qualified lawyer, but you have specialized in legal and economic topics, which qualifies you for work in companies, law firms or as a consultant.