General Partner Meaning: What is a General Partner?

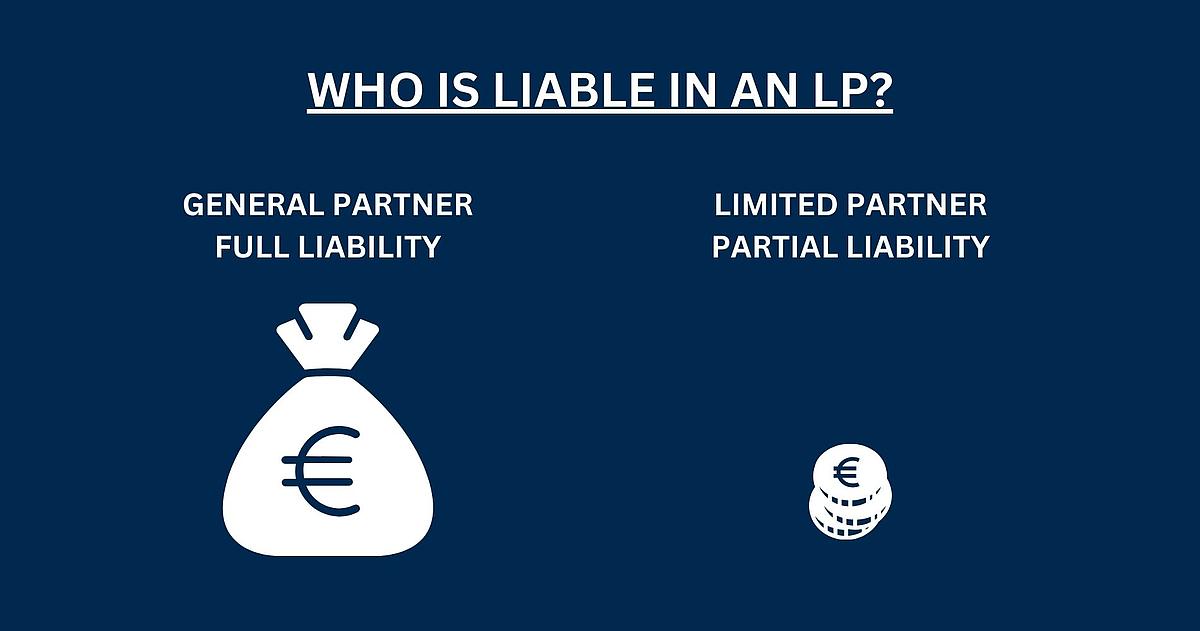

A general partner is an essential component of a limited partnership (KG) and refers to the partner who is liable for the debts and liabilities of the company with all his personal and business assets. This unlimited liability clearly distinguishes him from the limited partners, whose liability is limited to their capital contribution.

The importance of the general partner lies above all in his role as the supporting pillar of the company. By assuming unlimited liability, they provide creditors with a higher degree of security, which can be particularly advantageous in financial matters and when negotiating loans. In addition, he is usually actively involved in the management and decision-making processes, which enables him to manage the company in line with his vision and strategic direction.

Specifically, the general partner assumes the following tasks:

- Management: The general partner manages the day-to-day business of the KG and makes the day-to-day decisions.

- Representation: The general partner represents the KG externally, which means that he is authorized to act on behalf of the company and legally bind it.

- Liability: Due to the unlimited liability, the general partner bears a high financial risk, which requires careful and responsible Corporate Management.

This combination of tasks and responsibilities makes the general partner a key figure in the structure and success of a limited partnership.