Energy (gasoline, heating oil, electricity)

Energy prices are a major cost factor for most households and tend to be volatile, influenced by geopolitical events, changes in commodity markets and government policies. Fluctuations in energy prices have a direct impact on the costs of transportation, production and housing and therefore have a significant influence on the general price level.

Housing costs (rent, real estate prices)

For most people, housing costs are the largest single budget item. Changes in rental prices or the cost of real estate loans can therefore have a significant impact on the financial situation of households and the perception of inflation.

Healthcare

The cost of medical treatment, medication and health insurance often rises faster than the general price level. As healthcare expenditure is often unavoidable and essential, price increases in this area have a significant impact on the cost of living.

Education

The cost of education, including school fees, tuition fees and teaching materials, can also have a significant impact on household budgets, especially for families with children.

Conclusion

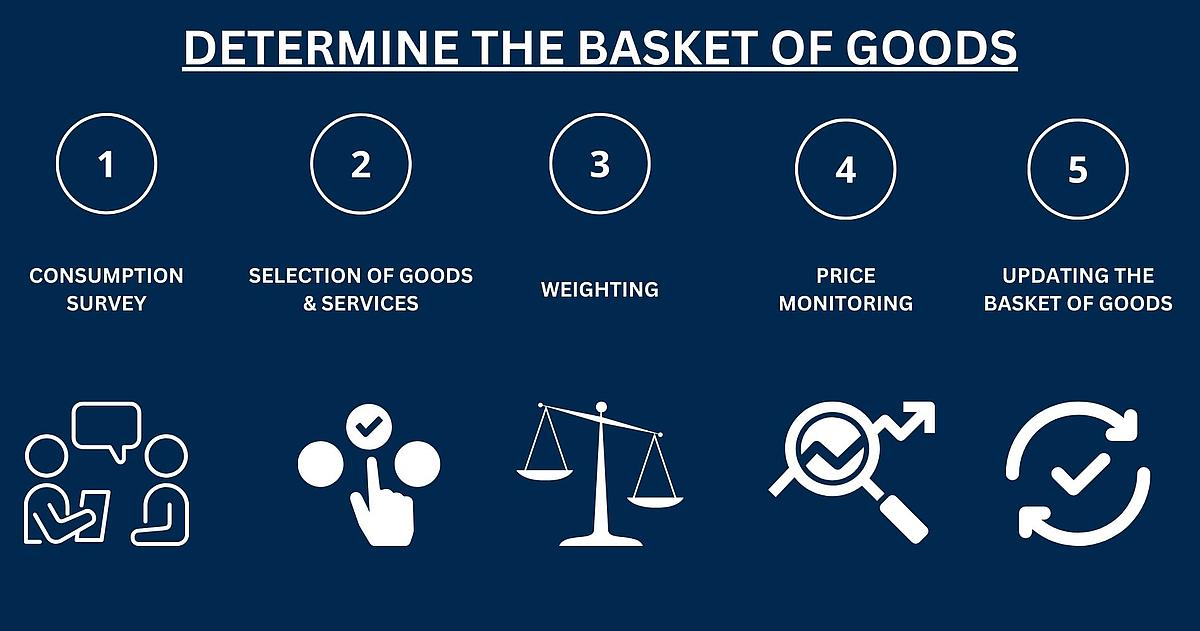

While price changes in these categories can strongly influence perceived inflation and the cost of living, it is important to note that central banks and statistical offices try to ensure a balanced consideration of all expenditure categories by weighting them in the consumer price index (CPI). Nevertheless, short-term strong price movements in these areas can influence the inflation rate and economic policy.