P&L Definition: What is P&L?

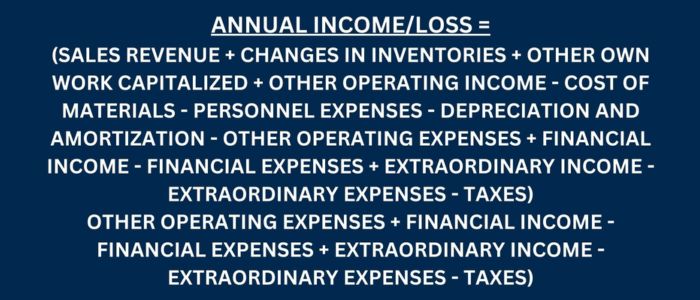

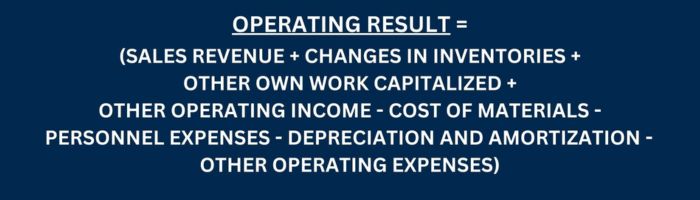

The income statement is an essential element of a company's annual financial statements, showing income and expenses over a specific period - usually a financial year. Its main purpose is to measure the success or failure of a company by determining the profit made or loss incurred.

The income statement structures the financial activities of a company and shows:

- Revenue: All revenue from the sale of goods and services and other income.

- Expenses: All costs and expenses incurred in the course of business activities, such as material costs, personnel expenses, depreciation and other operating expenses.

By comparing income and expenses, the company's net profit is calculated, i.e. the profit if income exceeds expenses, or the loss if expenses are higher than income. The income statement thus provides important information for Corporate Management, investors and other stakeholders to assess the financial situation and performance of the company.