Definition: What is Value Added Tax?

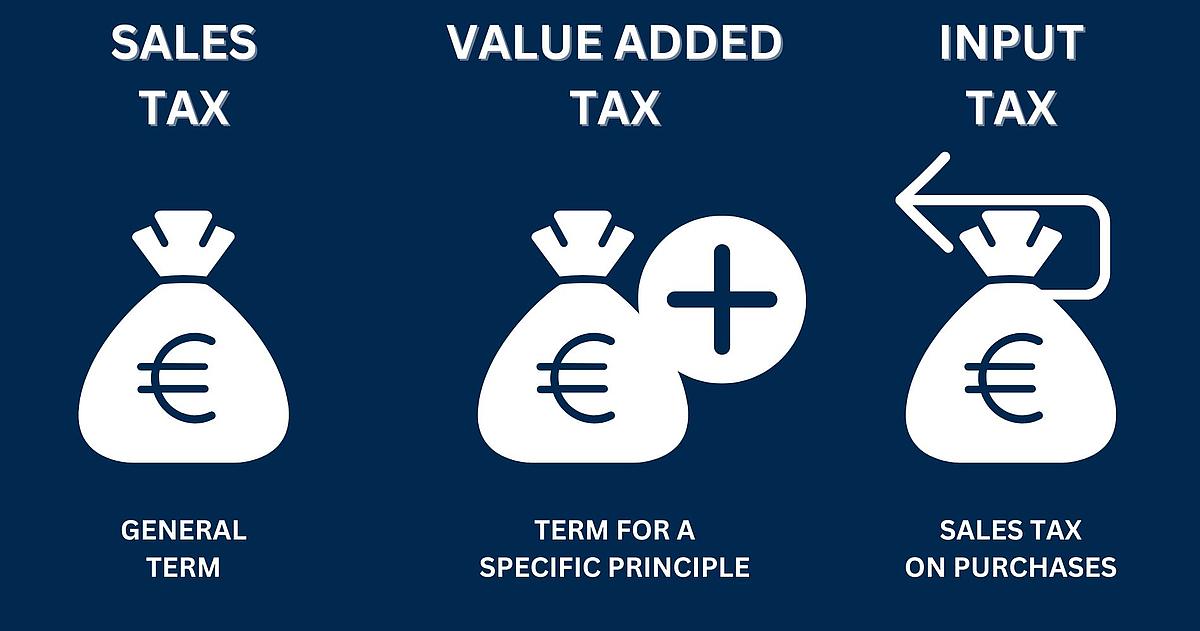

VAT is an indirect tax levied on the sale of goods and the provision of services. It is applied at every stage of the production and distribution chain, but is ultimately borne by the end consumer. This means that companies pay the tax to the tax office, but pass it on to the customer in the price of the goods and services. A key feature of VAT is the input tax deduction procedure, which allows companies to deduct the VAT they pay on purchases (input tax) from the VAT owed on their sales. This avoids double taxation and ensures that VAT is ultimately only paid by the end consumer. In many countries, especially within the European Union, sales tax is also known as value added tax (VAT) as it taxes the value added to the original value at each stage of production and distribution.

Value Added Tax Abbreviation

The abbreviation for Value Added Tax is "VAT". The concept of VAT was first introduced by French economist Maurice Lauré in 1954, who implemented it in France. The term "Value Added" refers to the incremental value that is added to a product at each stage of its production or distribution, and the tax is levied on this added value. The abbreviation "VAT" emerged as a convenient shorthand for referring to this tax system, making it easier to discuss, legislate, and implement.

VAT is used in over 160 countries worldwide as a crucial source of government revenue. The abbreviation "VAT" has become part of the common lexicon in finance, taxation, and everyday commerce. It is used in legislation, financial documents, and by businesses and consumers alike to refer to the tax that is applied to goods and services at each stage of production and distribution, excluding the final consumer. The use of the abbreviation facilitates clear communication, ensuring that discussions about tax policies, compliance requirements, and fiscal strategies are accessible and universally understood.

In everyday use, "VAT" is seen on receipts, invoices, and pricing labels, indicating the tax component of the cost of goods and services. Businesses use the term "VAT" when filing their tax returns, calculating the tax they owe based on the difference between the VAT they collect on sales and the VAT they pay on purchases. The abbreviation simplifies complex tax discussions, making the concept more approachable for both professionals in the field and the general public.