This Website uses cookies to improve your visit on our website. More Info

Money for your studies: How to find the right Student Loan

Student loans play a crucial role in the lives of many students who want to fulfill their dream of higher education. But while they open a door to countless professional and personal development opportunities, they also come with a long-term financial commitment. In this article, we highlight the many aspects of student loans, including the different types, terms and repayment options, as well as alternative options to student loans.

What is a Student Loan?

A student loan is a form of loan specifically designed to enable students to finance their higher education. This usually includes tuition fees, textbooks, accommodation, living costs and other study-related expenses. Unlike scholarships or grants, which do not have to be repaid, a student loan requires repayment of the amount borrowed plus interest. Terms, such as interest rates and repayment plans, can vary depending on the lender. Student loans are offered by government institutions, banks and other financial institutions to help students meet the financial challenges of study.

When does a student loan make sense?

A student loan makes sense if the educational investment leads to a significant improvement in career prospects and income opportunities and if other sources of funding such as scholarships, grants or family support are not sufficient to cover the costs of study. It also makes sense if the student has a solid plan for repaying the loan and the monthly repayment amounts realistically fit into the future budget.

A student loan, on the other hand, makes less sense if the potential income after graduation does not realistically allow the loan to be repaid or if the study or degree program does not promise a significant improvement in career opportunities. Caution is also advised if the loan amount is far higher than the actual requirement or if the loan can be waived through responsible budget planning and the use of other sources of financing. In such cases, the long-term financial burdens may outweigh the short-term benefits.

A Student Loan as a last resort?

A student loan should often be considered the last option for financing a study program, as it involves long-term financial commitments and accrues interest that increases the overall cost of the apprenticeship. Unlike scholarships and grants, which do not have to be repaid, repaying a student loan can be a significant financial burden for years to come. This can limit the alumni's financial freedom, such as saving for other goals, investing or borrowing for large purchases like a home. In addition, a high debt load can increase stress after study and affect career decisions by forcing alumni to choose jobs based on salary rather than personal fulfillment or career aspirations. Therefore, it is recommended to exhaust all other available funding options first, such as family support, part-time work, scholarships and government assistance programs.

DID YOU KNOW?

In cooperation with BRAIN CAPITAL, MBS offers the EDUCATION FUND as a financing offer that enables students from the EU, Switzerland, Great Britain, the USA, Japan, Iceland, Norway, Australia and Canada to realize their dream of studying at MBS.

Additional brief questions about the student loan

Interest-free student loans are the exception rather than the rule, but there are certainly situations and programs that can offer such conditions. These are often subject to specific conditions or limited to certain groups of students. Here are some examples of where and how you may be able to get an interest-free student loan:

- Government support programs: In some countries, state or public institutions offer interest-free loans or loans with very low interest rates for students. These are often means-tested and may require proof of financial situation.

- Educational institutions: Some universities or colleges have their own funds or programs to support their students, which may offer interest-free loans or emergency aid.

- Foundations and non-profit organizations: Various foundations and NGOs occasionally offer interest-free loans for students, often linked to specific study goals, research projects or social engagement.

- Religious and cultural institutions: Some religious and cultural communities make interest-free loans available to their members for educational purposes.

You should also bear in mind that even interest-free loans have to be repaid. Careful planning of your financial situation and your ability to repay is therefore essential to avoid financial difficulties.

Yes, it is possible to obtain a student loan even without your own income. Many government and private support programs are specifically designed to offer financial support to students who have little or no income during their studies. With private lenders, a guarantor, usually a family member with a regular income, can often assume liability for the loan. In addition, some programs and loan offers explicitly take into account the financial need of students and do not require an income of their own. It is crucial to carefully examine the loan conditions and consider your own repayment options after your studies.

A student loan can also be granted as a one-off payment in some cases, especially when it comes to specific expenses such as tuition fees or funding a semester abroad. Such loans are often designed to support targeted investments in education and are then paid out in one lump sum rather than spread over several smaller payments. The repayment terms of these loans vary depending on the lender and agreement, with a set repayment schedule usually beginning after study or a specific event. It is important to find out exactly what the terms are beforehand and ensure that the repayment arrangements match your financial means.

The KfW Student Loan is a loan offered by the KfW Bank (Kreditanstalt für Wiederaufbau) in Germany that provides students with financial support, regardless of their income or that of their parents. It is particularly flexible in terms of the amount and adjustment of monthly payments and enables the financing of different phases of study. Repayment does not begin until years after graduation, giving alumni time to gain a financial foothold. Its broad accessibility and comparatively favorable conditions make it an attractive financing option for students.

Student Loan Advantages and Disadvantages

The following structured presentation provides a clear overview of the key aspects that should be considered when deciding on a student loan. Here is a table with the advantages and disadvantages of a student loan:

| Advantages | Disadvantages |

|---|---|

| Provides access to higher education when other sources of funding are insufficient | Creates long-term financial commitments |

| Provides financial flexibility for tuition fees and living expenses | Interest increases the overall cost of apprenticeship |

| Can offer favorable terms, e.g. low interest rates and flexible repayment plans | Can limit financial flexibility after study |

| Allows focus on study without financial worries | Potential stress and pressure of uncertain career prospects |

Requirements: You have to pay attention to this

Student loan eligibility requirements can vary by lender and country, but here are some common criteria and points to look out for:

Requirements

- Enrolment: Proof of enrolment at a recognized college or university.

- Creditworthiness: Positive credit check, often through a Schufa entry or similar information in other countries.

- Proof of income: Some lenders require proof of regular income or a guarantee. However, Bafög and child benefit do not count as income.

- Nationality or residence status: In some cases, applicants must be a citizen of the country or provide proof of valid residence status.

- Age limits: Some loan programs set minimum or maximum age limits for applicants.

- Study progress: The progress made in your studies can play a role, especially for educational loans.

What to look out for

- Interest rates: Compare fixed and variable interest rates and how they affect the overall cost of the loan.

- Repayment terms: Understand when repayment begins, whether there is a grace period after study and how flexible the repayment plans are.

- Total cost of the loan: Consider not only the interest rates, but also any fees that may increase the total cost of the loan.

- Eligibility: Make sure you meet the lender's specific requirements and submit all necessary documents in full and on time.

- Additional conditions and small print: Pay attention to any additional costs, penalties for early repayment or the consequences of late payment.

- Compare different offers: It is worth comparing different loan offers and considering not only the conditions, but also the quality of service and the experiences of other borrowers.

Carefully reviewing and understanding all terms and conditions before taking out a student loan is crucial to avoid financial difficulties during or after study.

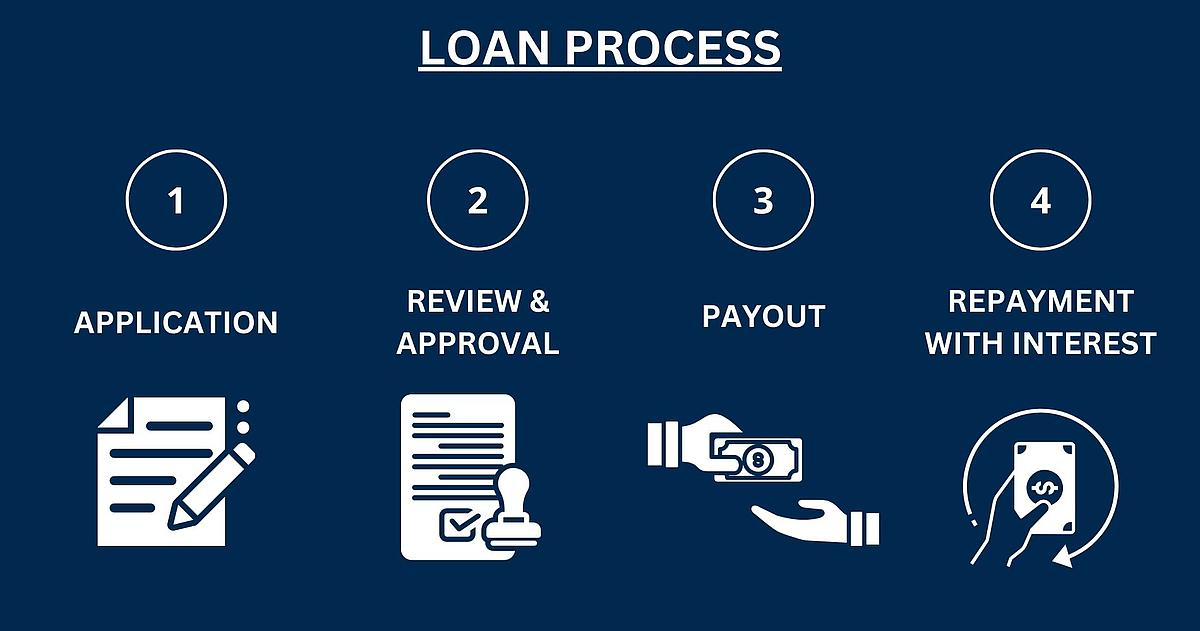

Student Loan Process

A student loan basically works as a loan that is specifically designed to help students finance their studies and related costs such as tuition fees, living expenses, books and materials. The basic steps and features of how a student loan typically works are explained below.

Overview of the steps

These 4 steps roughly describe the process of a loan:

Steps of the Student Loan process explained in more detail

By taking out a student loan, the student undertakes to repay the amount borrowed plus interest within a set period of time. It is important to check the conditions carefully and only take out the amount that is actually needed in order to avoid unnecessary debt.

- Application: The student submits an application for a student loan to a bank, a credit institution or a state funding program. This application includes personal information, proof of enrollment at a college or university and often proof of financial need.

- Review and Approval: The lender reviews the application, which may include a credit check to assess the applicant's creditworthiness. If approved, the terms of the loan are set, including the interest rate, loan amount and repayment terms.

- Payout: Once approved, the loan amount is usually disbursed directly to the student or, in some cases, directly to the educational institution to cover tuition fees. The disbursement can be made once or in installments.

- Repayment: Repayment of the student loan begins after an agreed grace period, which often begins after graduation. This gives the graduate time to find employment and stabilize financially. Repayment is made in monthly installments that cover both the amount borrowed and the interest incurred.

- Interest: The interest rate for student loans can be fixed or variable and is calculated on the outstanding loan amount. Interest can accrue while you study or be deferred until the repayment period begins.

- Flexibility and funding: Some student loans offer flexible repayment plans or the possibility of funding under certain conditions, such as public service or low income.

Types of

student loans

| State-subsidized student loans | Often low-interest or interest-free. |

|---|---|

| Repayment terms are usually student-friendly, with forbearance periods and customized repayment plans. | |

| Can be based on need and often does not require proof of creditworthiness. | |

| Private student loans | Offered by banks, credit unions or other private organizations. |

| Interest rates and terms vary and are often higher than government-backed loans. | |

| Credit checks and creditworthiness are usually required. | |

| Education loans | Specifically designed to cover education costs, sometimes for further education courses or special study programs. |

| Can be offered by government or private lenders. | |

| Often offer flexible repayment options tailored to students' needs. | |

| Student loans for international students | For students who want to study abroad or come from abroad. |

| May have higher interest rates and stricter repayment terms. | |

| Often require a guarantor or proof of stable income. | |

| Student loan consolidation loans | Allow multiple student loans to be combined into a single loan with one monthly payment. |

| Can help simplify the management of multiple loans and potentially secure better interest rates. | |

| Important to check whether this actually results in financial savings. |

There are different types of student loans, each addressing different student needs and situations. Each of these loan types has its own advantages and disadvantages, and the choice depends on the student's individual circumstances, needs and goals. It is important to carefully review and compare the different options to find the best financing solution for your studies.

What to consider when comparing student loans

Comparing loans is extremely important for several reasons:

- Interest rates: These can vary considerably and affect the overall cost of the loan. A lower interest rate can reduce monthly payments and save significantly over the life of the loan.

- Fees and costs: Some loans may include additional fees, such as processing fees or upfront fees, which increase the cost.

- Repayment terms: Different loans offer different repayment options, including length of repayment, flexibility in case of financial difficulties and early repayment options.

- Customer service: The quality of customer service and assistance with repayment problems can vary. It's important to choose a lender that offers support when needed.

- Eligibility requirements: Some loans, especially government-backed ones, offer special terms such as interest-free periods or subsidies for certain professions.

- Tailoring to personal needs: Not every loan suits every situation. By making a comparison, you can find a loan that best suits your individual financial possibilities and needs.

- Avoidance of over-indebtedness: Careful comparison and selection can avoid taking out unnecessarily high or unfavorable loans, which contributes to a long-term sustainable financial situation.

Overall, comparing loans helps you make an informed decision that minimizes long-term financial impact and ensures that the loan terms are the best fit for your personal and financial circumstances.

Difference: Student Loan & other types of Loans

This table provides an overview of the most important features and differences between various types of financing for education, such as student loans, educational loans, Bafög and normal loans.

| Features | Student Loan | Education Loan | Bafög | Normal Loans |

|---|---|---|---|---|

| Purpose | Financing of studies and living costs | Additional financing in advanced study phases | Financial support, half of which is granted as a grant and half as an interest-free loan | General consumption, real estate, vehicles, etc. |

| Interest rates | Variable, often cheaper than normal loans | Low, state-subsidized | No interest | Standard market interest rates |

| Repayment terms | After end of studies, often with waiting period | Fixed term, begins during studies | Repayment of loan portion, limited amount | Directly after disbursement, monthly installments |

| Availability | Students, often dependent on credit rating | Students in advanced study phases | Students in need | Broad public, dependent on credit rating |

| Requirements | Proof of enrolment, often proof of income | Proof of enrolment, in certain study phases | Parents' income, own financial circumstances | Proof of income, credit check |

| Start of repayment | Usually after graduation | During study or shortly thereafter | Five years after the end of the standard period of study | Immediately after loan disbursement |

General conditions for student loans

The details regarding the maximum funding period, the maximum amount of money you can receive, and the usual interest rate vary greatly depending on the type of student loan, the country you are studying in and the specific lenders. Here is a general overview:

Maximum funding period

- State-funded student loans: The funding period is often based on the standard period of study for the respective degree program plus possibly one or two tolerance semesters. In Germany, for example, funding can be granted by the Bafög for the standard period of study plus possibly an extension semester.

- Private student loans: The duration can vary and is often more flexible, but is generally also based on the standard period of study. Some private lenders offer additional funding periods, especially for longer or more advanced courses.

Maximum amount of money

- State-subsidized loans (e.g. Bafög in Germany): The maximum grant amount is calculated on the basis of need and includes living costs, tuition fees and other expenses. The maximum rate is set by law and can change annually.

- Private student loans: The maximum loan amount can be significantly higher and is based on the cost of study and the applicant's creditworthiness. Some lenders cover the entire cost of study.

Usual interest rate

- State-subsidized loans: Often low or even interest-free during your studies; in Germany, for example, Bafög is interest-free.

- Private student loans: Interest rates can vary and are usually higher than for state-subsidized loans. They can be fixed or variable and depend on the applicant's creditworthiness and market conditions. Common interest rates range from under 1% for some government-subsidized loans to 5% or more for private loans, depending on the country and lender, but can range from a few percentage points to significantly higher rates.

It is important to check directly with the relevant lenders or government agencies for the most up-to-date information, as terms and conditions may change.

Important terms on the subject of

credit at a glance

| Term | Explanation |

|---|---|

| Student loan | A loan that helps students finance their apprenticeship and related costs. |

| Bildungskredit | A state-subsidized loan offered specifically to finance educational expenses in advanced stages of study. |

| Bafög | State educational assistance in Germany, half of which is granted as a grant and half as an interest-free loan. |

| Interest rate | A percentage applied to the borrowed capital of a loan that determines the cost of borrowing. |

| Grace period | A period of time after graduation during which the alumni is not required to repay the loan. |

| Repayment | The repayment of the borrowed principal and interest on a loan. |

| Creditworthiness | An assessment of a borrower's ability to repay a loan in full and on time. |

| Credit check | A review of an individual's financial history to determine their creditworthiness. |

| Repayment schedule | An agreed plan between borrower and lender that determines the amount and frequency of repayments. |

| Default interest | Additional interest charged when loan installments are paid late. |

These terms provide a comprehensive overview of the most important aspects and concepts related to financing a study through loans.

Tips for Student Loans

To apply for and obtain a student loan, as well as create a repayment plan, the following steps and tips can be helpful. By following these steps and tips, you can ensure that you are making informed decisions that will support your financial future.

Borrow only what you need

Only borrow as much money as you really need for your studies to keep your debt as low as possible.

Credit Agreement

Read the loan agreement carefully before you sign it. Pay attention to interest rates, repayment conditions and any fees.

Early Planning

Think early on about your repayment capacity and how the loan fits into your future budget. A precise repayment plan can help.

Understanding Interest Rates

Understand the difference between fixed and variable interest rates and how they affect the overall cost of the loan.

Flexible Repayment Options

Look for loans with flexible repayment options so that you have room for maneuver in the event of financial bottlenecks.

Early Repayment

Find out whether it is possible to repay the loan early without penalty in order to save interest costs.

Use State Funding Opportunities

Check whether you qualify for state subsidies or low-interest loans before taking out a private loan.

Take Advantage of Advice

Use your university's counseling services, financial counseling services or credit counselors to make the best decision.

More information on other funding options & scholarships:

What happens if I drop out of university?

If you drop out of university, the debt associated with the student loan must usually still be repaid. The exact consequences and further procedure depend on the specific terms of the loan and the lender. Here are some general points to bear in mind:

- Repayment begins anyway: The fact that the study was not completed does not release you from the repayment obligation. The conditions for repayment set out in the loan agreement remain valid.

- Possible change in repayment conditions: Some lenders offer a grace period after dropping out before repayment begins. Others may require repayment to begin immediately or after a short transition period.

- Negotiating with the lender: It is important to contact the lender as early as possible to discuss the situation. In some cases, the lender may be willing to adjust the repayment terms, especially if there are financial difficulties.

- Consequences of late payment: If you fall behind with payments, this can have a negative impact on your credit score and result in additional fees or interest. In the worst case scenario, the lender may take legal action to recover the outstanding debt.

- Options for financial assistance: There may be programs or counseling services that can provide assistance in dealing with debt, such as debt counseling or government assistance programs.

- Consider alternative educational paths: Even if you dropped out of your original study program, continuing your education in a different field or at a different institution may be worth considering. Find out about ways in which your previous coursework and credits can be applied to new educational goals.

Dropping out of university is a difficult decision and the financial obligations involved can be stressful. Taking a proactive stance and seeking advice and support can help determine the best course of action for repaying your student loan in these circumstances.

FAQ

Whether Bafög or a student loan is the better option depends on the student's individual circumstances and needs. Bafög, the state education grant in Germany, offers the advantage that half of it is granted as a grant that does not have to be paid back and the other half as an interest-free loan. This makes it a very attractive option for students who meet the eligibility criteria. A student loan, on the other hand, must be repaid in full with interest, but offers flexibility in terms of the amount and availability of funds, especially for those who are not eligible for Bafög or whose needs go beyond what Bafög can cover. In short, Bafög is usually the more cost-effective option, but student loans can be an important resource to fill funding gaps.

To get a student loan, you typically start by researching various lenders, such as banks, credit unions and government assistance programs. The process usually involves submitting an application that asks for personal information, proof of enrollment at a college or university, and often proof of your financial situation and sometimes your academic record. Many lenders will also run a credit check to assess your creditworthiness. Once your application has been reviewed and approved, the terms of the loan will be determined, including the interest rate, repayment period and monthly repayment amount. It is important to carefully review and understand the loan terms before signing a contract.

The amount of a student loan can vary greatly and depends on several factors, such as the cost of the apprenticeship, living expenses, the specific loan program and the student's individual needs. Some programs set caps, while others adjust the loan amount based on actual need. In general, loans can range from a few thousand to tens of thousands of dollars to cover tuition, books, housing and other essential living expenses. It is important to calculate exactly how much money is actually needed before applying in order to cover your needs on the one hand, but also to keep the future debt burden as low as possible on the other.

The limit of a student credit card varies depending on the provider and can range from a few hundred to several thousand euros. This limit is determined based on various factors, including the student's credit score and income or financial collateral. As student credit cards are specifically designed for students who may not yet have an extensive credit history, the limits are usually lower than for standard credit cards. The goal is to give students the opportunity to use credit while encouraging responsible spending habits.

Yes, international students can apply for student loans in Germany under certain conditions. The accessibility and criteria depend on the lender and may include a valid residence permit, proof of enrollment at a German university and possibly a guarantor or demonstrable income. Some government and private loan programs are specifically designed to support international students. However, it is important to inform yourself thoroughly in advance and to understand the conditions and repayment terms.

Interested in a study program? Request our information material now!

More exciting degree programs in Munich