This Website uses cookies to improve your visit on our website. More Info

Working Student: What you should look out for!

Discover the world of working students - a unique opportunity for students to gain valuable work experience alongside their studies. As an enrolled student working part-time in their field of study, a working student enjoys the double advantage of applying their knowledge while expanding their network in the professional world. This position opens the door to flexible working hours and the chance to put theoretical knowledge into practice.

What is a Working Student?

A working student is a student who pursues a job-related activity in parallel to their full-time studies in order to gain practical experience in their field of study or a related field and earn some extra money. Employment offers a working student the opportunity to put theoretical knowledge into practice, gain valuable professional experience and expand their personal network. The pay and working conditions of a working student can vary depending on the industry, company and region. This combination of work and study allows working students to supplement their academic apprenticeship with practical experience while earning an income.

What does a Working Student do?

A working student typically works in a company or organization that fits their field of study or a related field. The activities and location of a working student can vary greatly depending on their field of study, interests and the specific requirements of the employer. Here are some general aspects:

Where does a Working Student work?

- In companies: Many working students find positions in private companies, from start-ups to large corporations.

- At public institutions: Some working students work for state or municipal administrations, universities or research institutions.

- In non-profit organizations: Employment of working students in associations, NGOs or foundations is also possible.

In which area does a Working Student work?

The areas of application are wide-ranging and depend on the degree program. Examples are:

- Engineering: Work on technical projects, support in product management or in research and development.

- Economics: Activities in marketing, controlling, human resources or finance.

- Computer science: Software development, data analysis or IT support.

- Social sciences and humanities: Work in research, educational programs or public relations.

What are the work activities of a Working Student?

The specific tasks depend on the area of work, but often include:

- Project work: Collaboration of the working student on specific projects, often with a clear goal or end product.

- Supporting activities: Assistance work for professionals, preparation of documents, research tasks.

- Practical application: Applying knowledge learned in studies to real work processes.

- Learning: In addition to practical work, many student trainee positions also offer the opportunity to learn new skills and further your education.

Overall, working as a student trainee offers the opportunity to gain professional experience, expand your professional network and deepen your skills in a real working environment.

What are the Requirements for becoming a Working Student?

In order to work as a working student, certain requirements must be met. These requirements help define and regulate working student status and allow students to gain practical experience without neglecting their studies. The following criteria ensure that working student status is justified and that the working student's focus is on their studies:

| Enrolment at a university | A working student must be enrolled at a state or state-recognized university in Germany. This applies to both Bachelor's and Master's students. |

|---|---|

| Full-time study | As a rule, a working student must be enrolled as a full-time student. However, part-time students can also work as working students under certain circumstances as long as their studies are considered their main activity. |

| Working time limits | During the semester, a working student may not work more than 20 hours per week in order to maintain working student status. However, full-time work is possible during the semester break. Exceptions apply to evening and weekend work, which is handled more flexibly. |

| Professional reference | Although no direct professional reference between the study and the working student activity is prescribed, it is advantageous if the work experience is in the working student's field of study or a related field in order to gain relevant professional experience. |

| Observe social security limits | As a working student, you must observe certain limits regarding income and working hours in order to remain exempt from social security contributions for health, long-term care and unemployment insurance. However, working students are subject to compulsory pension insurance. |

| Valid residence permit | If the working student is an international student, they need a valid residence permit that allows them to work. There are specific regulations on how many hours the working student is allowed to work. |

Working Student Salary & Working Student Earnings Limit

The salary of a working student in Germany can vary greatly depending on factors such as industry, company size, location and your own qualifications. As of 2023, the average hourly wage for working students is often between 10 and 15 euros, although higher rates of up to 20 euros per hour or more are possible in certain industries such as IT, engineering or consulting.

There is no statutory earnings limit specifically for working students in terms of their total income. The main regulation concerns working students' social security: they remain exempt from social security contributions for health, long-term care and unemployment insurance as long as they do not work more than 20 hours per week during the semester. They may also work full-time during the semester break without losing their status.

However, there is no exemption for pension insurance: working students are generally subject to pension insurance, although a tax free amount applies up to which the income is not subject to pension insurance. This aspect can influence the net income.

For income tax purposes, the usual tax free amounts and tax brackets apply, which are relevant for all employees in Germany. As long as the annual income of a working student is below the basic tax-free allowance, no income tax is generally payable. However, it should be noted that wages from working student activities count towards total income and that tax obligations or effects on BAföG benefits may arise if certain limits are exceeded.

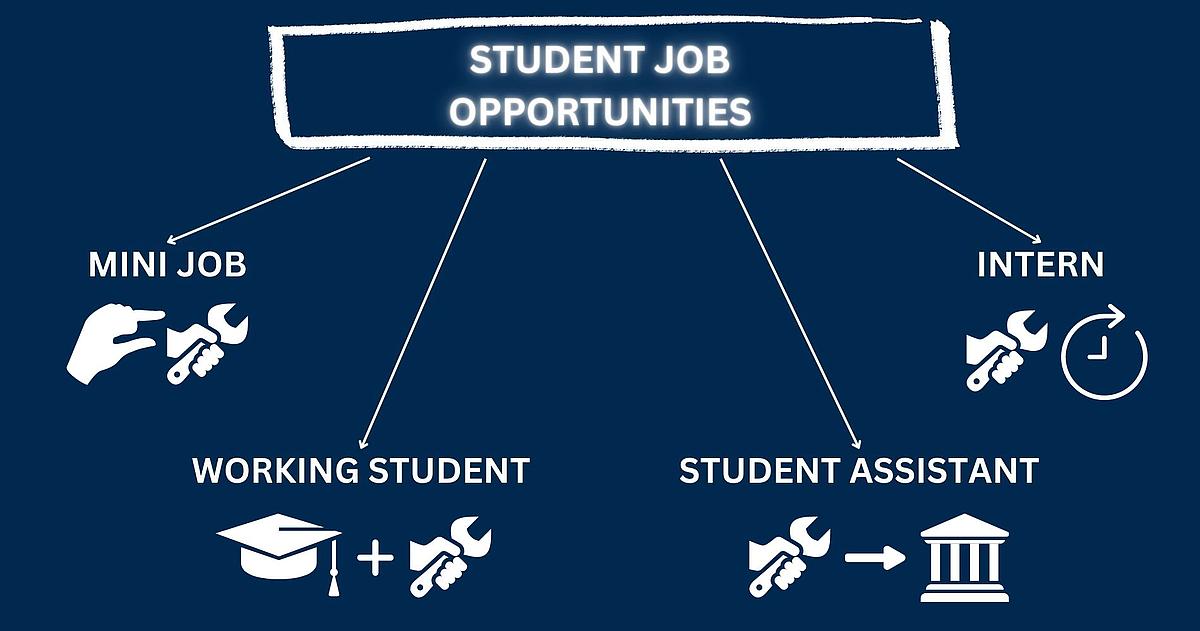

Working Student or Minijob: What Student Jobs are there?

There are different types of job opportunities for students alongside their studies, which require students to have different skills and challenge their knowledge and abilities in different ways. The choice of work depends on the respective goals and opportunities. Common student jobs include:

Working Student or Mini Job: What are the Differences?

Working student jobs, mini-jobs, student assistant positions and internships offer students different opportunities to gain work experience, support themselves financially and expand their network. Each of these forms of employment has its own benefits and may be the right option depending on the student's individual needs and goals. Here are the key differences between these forms of employment:

Working Student

- Working hours: Up to 20 hours per week during the semester; full-time during the semester break.

- Social insurance: Exempt from health, long-term care and unemployment insurance under certain conditions, but subject to pension insurance.

- Remuneration: Often higher than for mini-jobs; based on hourly wage or salary.

- Field of activity: Work is often subject-specific and related to your studies.

Mini Job

- Working hours: Flexible working hours; total income must not exceed 450 euros per month.

- Social security: Flat-rate tax and social security contributions; as a rule, the employee is not required to pay pension insurance.

- Remuneration: Up to 450 euros per month.

- Field of activity: Often general or supporting activities; not necessarily subject-specific.

Student Assistant

- Working hours: Usually up to 20 hours per week; varies depending on the university and institute.

- Social insurance: Similar to working students, often exempt from social insurance under certain conditions.

- Remuneration: Varies, often determined by the university or institute.

- Field of activity: Work usually takes place at the university or in university-related research institutions, often related to the study.

Intern

- Working hours: Full-time for the duration of the internship, often lasting between a few weeks and several months.

- Social insurance: Compulsory insurance in all branches of social insurance, depending on the amount of pay and duration of the internship.

- Remuneration: Can vary; some internships are unpaid, others offer an expense allowance or a salary.

- Field of activity: Focused on learning job-specific skills and gaining practical experience in a specific field; often part of the study regulations.

More on this Topic here:

Working Student: Most

important facts summarized

| Working hours | Up to 20 hours per week during the semester; full-time possible during semester breaks. |

|---|---|

| Health insurance | Working students can take out student insurance or remain covered by family insurance, provided their income does not exceed 470 euros (as of 2023). |

| Social insurance | Exemption from unemployment and long-term care insurance if the 20-hour limit is met. |

| Pension insurance | Generally subject to pension insurance, with the possibility of exemption under certain conditions. |

| Family insurance | Possibility of free co-insurance under certain conditions (observe income limit). |

| Child benefit | Entitlement exists up to the age of 25, provided the weekly working hours do not exceed 20 hours. |

| Taxes | Tax liability according to individual income. Use of the basic tax-free allowance possible; income tax is payable if income exceeds the basic tax-free allowance. |

| Vacation entitlement | Entitlement exists in accordance with the regulations set out in the employment contract, often pro rata to working hours. |

| Contract | Written employment contract that regulates details such as area of responsibility, working hours, remuneration and vacation entitlement. Working student status must be specified in the contract. |

This table summarizes the most important aspects of a working student relationship in Germany, based on current legislation and common practice. Please note that regulations may change and it is important to contact the relevant office directly if you have specific questions.

Working Student: Important Rules briefly explained

The following two rules are designed to define the special status of working students within the German social security system while ensuring that their studies remain a priority. The two regulations relating to working students in Germany mainly concern social security and working hours:

The basic working student rule defines the criteria under which students are allowed to work as working students. This includes that they must be enrolled at a university and their studies must be their main occupation. The rule limits weekly working hours to a maximum of 20 hours during the semester to ensure that their studies are not interfered with by their work. Working students are exempt from paying into health, long-term care and unemployment insurance as long as they meet these conditions, but must make contributions to pension insurance. This arrangement allows students to gain work experience while still mainly pursuing their studies.

This rule states that working students may not work beyond the 20 hours per week limit for more than 26 weeks or 182 calendar days within a year (12 months) without losing their status as a working student for social security purposes. This means that they can work more during this period for limited peak periods without this having an immediate impact on their social security contributions. It allows some flexibility, for example, to work full-time during the semester break.

Find a Working Student Job

The key aspects of a working student application are thorough preparation, tailoring your application to the specific job and company, and presenting your skills and experience in a positive light. Finding a working student job and the application process can vary depending on the industry, company and location. However, here are general steps and tips that can help you:

How do you find a Working Student Job?

Career Portals and Job Fairs

Use specialized career portals for students and alumni as well as general job boards. Many companies publish their student trainee positions online.

University Services

Universities often offer career services that include job postings and organize career fairs where you can meet potential employers.

Company Websites

Visit the careers pages of companies that interest you. Large companies often have special pages for working student positions.

Networking

Use your personal network, including family, friends and university contacts. LinkedIn and XING are also useful for making connections and finding out about open positions as a working student.

Unsolicited Applications

If you are very interested in a particular company but cannot find any suitable job advertisements, you can send an unsolicited application as a working student.

Working Student Application and what you should look out for

CV and Cover Letter

Your CV should be up-to-date and professional. In your cover letter, explain why you are interested in the position and why you are the right candidate. Refer to the specific requirements of the job advertisement as a working student.

Relevance to your Studies

Show how the content of your studies and any experience you have already gained fit in with the position of working student.

Soft Skills and Commitment

In addition to professional qualifications, employers are also interested in soft skills and your commitment, e.g. in university groups or volunteer work.

Preparing for the Interview

Inform yourself thoroughly about the company and be prepared to talk about your professional skills as well as your motivation and goals.

Pay Attention to Details

Make sure that your application documents for the working student position are complete and that your contact details are correct. Check your documents for spelling and grammar.

Prepare Questions

Prepare questions that you can ask in the interview for the working student position to show your interest and motivation.

Working Student Advantages & Disadvantages

The following table provides an overview of the advantages and disadvantages that should be considered when deciding on a working student job.

| Advantages | Disadvantages |

|---|---|

| Practical experience: Direct insight into the world of work and gaining professional experience in your field of study. | Time management: The challenge of balancing study and work, especially during exam periods. |

| Financial independence: Opportunity to earn money and possibly be less dependent on loans or support. | Social security contributions: Although you are exempt in some areas, pension insurance is compulsory, which can reduce your net salary. |

| Networking: Opportunity to make professional contacts and build relationships in the industry. | Limited free time: Less time for hobbies, recreation and social activities. |

| Application of study content: Opportunity to practically apply and deepen theoretical knowledge. | Possible excessive demands: Risk of stress and overload due to the double workload. |

| Better career entry: Improved chances on the job market through relevant work experience. | Less flexibility in study: restrictions in the choice of courses or participation in university events. |

| Acquisition of soft skills: Development of skills such as teamwork, time management and communication skills. | Restrictions on working hours: In order to maintain status, students are generally not allowed to work more than 20 hours per week during the semester. |

Working Student: Employment after Graduation

At the end of your studies, it is even possible to be taken on by the company where you worked as a working student. This opportunity can be beneficial for both sides, as the company is already familiar with your way of working and your contribution to the team and you know the company, its culture and processes. Here are some tips to increase your chances of being taken on:

- Show performance: Prove through your work that you are a valuable addition to the team. Quality, reliability and commitment are key traits that employers are looking for.

- Take initiative: Show initiative by asking for new tasks, making suggestions for improvement and agreeing to take on additional responsibilities.

- Willingness to learn: Take the opportunity to learn as much as you can, both in your specific area of work and about the company in general. Show that you are willing to develop and learn new skills.

- Network: Build relationships within the company, not just in your department but beyond. Good relationships can be crucial when it comes to recommendations for a permanent position.

- Express interest: If you're interested in staying with the company after your studies, talk openly about your career goals with your supervisor or HR. Sometimes employers don't know about your interest unless you explicitly state it.

- Professionalism: Maintain a professional attitude, even if you already feel comfortable in the team. This includes punctuality, appropriate communication and adherence to company policies.

- Thesis: If possible, consider writing your Bachelor's or Master's thesis in collaboration with the company. This can not only strengthen your bond with the company, but also show how you can apply scientific knowledge to practical problems.

However, a takeover is also dependent on external factors such as the economic situation of the company and available positions. However, by taking the steps mentioned above, you can significantly improve your chances and position yourself as a valuable addition to the company.

Frequently asked Questions about Working Students

No, working student jobs and mini-jobs are not the same thing. A working student job refers to employment of students who work in their department or a related field in parallel to their studies, often working up to 20 hours per week during the semester. This employment is exempt from social security contributions as long as it meets certain conditions. A mini-job, on the other hand, is marginal employment where the income does not exceed 450 euros per month. Mini-jobs are possible in various sectors and are not specifically limited to students. They are subject to their own regulations regarding taxes and social insurance.

Yes, you can work as a working student and in a mini-job at the same time. However, it is important to observe the legal regulations regarding maximum working hours and social security obligations. During the semester, students are generally not allowed to work more than 20 hours per week in order to maintain their status as a working student. The combination of working student employment and mini-job may not exceed this limit. In addition, the combination of both jobs could have an impact on social security contributions, depending on total income and working hours.

As a working student, you are allowed to earn in addition to BAföG, but there are tax free amounts that must not be exceeded without your BAföG being reduced. The current tax free amount is 5,400 euros per year (as of 2023). Income above this amount can lead to a reduction in your BAföG entitlement. It is important to note that this tax free amount applies to all income, i.e. wages from a working student job as well as from other part-time jobs. When calculating the allowable income, income-related expenses or lump sums are taken into account, which can affect the amount actually available.

A "good" salary for a working student can vary depending on the industry, region and qualifications of the student. In Germany, the average salary for working students is usually between 10 and 15 euros per hour (as of 2023). In certain industries such as IT, engineering or consulting, hourly rates can also be higher, sometimes up to 20 euros per hour or more, depending on the specialization and demand for these skills. A "good" salary is therefore relative and depends on the factors mentioned as well as the cost of living in the respective region.

Working students are not treated differently from other employees for tax purposes and their tax class depends on their personal situation. If a working student is single and this is their only job, they will usually fall into tax class 1. If the working student is married or has children, other tax classes such as tax class 3, 4 or 5 could also be considered, depending on the specific circumstances and decisions regarding payroll tax deduction. Membership of a particular tax class therefore depends on the working student's personal circumstances, not their status as a working student.

Interested in a study program? Request our information material now!

More exciting Degree Programs in Munich